What should we do with Interest Rates during a Credit Crunch?

Some observations:

1) The widespread unavailability of credit is like a shortage of capital.

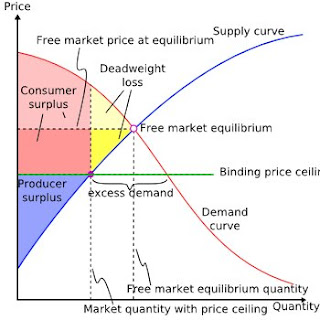

2) Resources are more efficiently allocated during a shortage by higher prices. (Economists show this by pointing to a complicated diagram, like the one below.)

3) Lowering interest rates lowers the price of money.

4) Everyone's lowering interest rates in response to the credit crisis.

I assume I'm missing something?

|